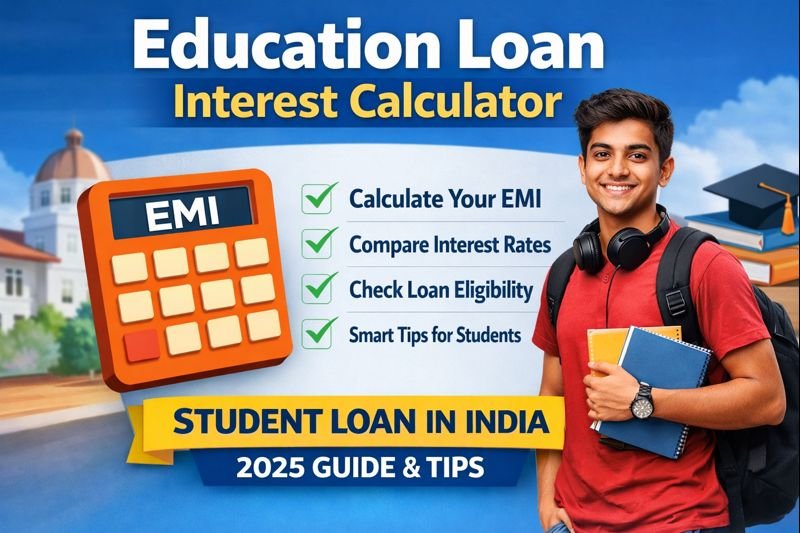

Education Loan Interest Calculator – EMI, Eligibility & Tips (2025)

Higher education is an important investment for students in India. With rising tuition fees, education loans help students achieve their academic goals without financial stress. An Education Loan Interest Calculator allows students to estimate monthly EMI, total interest, and repayment amount before applying.

What Is an Education Loan?

An education loan is a financial facility offered by banks and NBFCs to students for pursuing higher studies in India or abroad. It usually covers tuition fees, hostel expenses, books, laptop costs, and sometimes travel expenses.

Most banks provide a moratorium period, meaning repayment starts after course completion.

Education Loan EMI Calculator

Use the calculator below to estimate your education loan EMI easily.

How Is Education Loan EMI Calculated?

Education loan EMI is calculated using a standard formula based on loan amount, interest rate, and tenure. Instead of manual calculations, using an education loan EMI calculator ensures accuracy and saves time.

Education Loan Interest Rates in India

Public Sector Banks

- Interest Rate: 8% – 10%

- Lower interest burden

- Government-supported schemes

- Longer repayment tenure

Private Banks & NBFCs

- Interest Rate: 10% – 14%

- Quick loan processing

- Flexible repayment options

- Higher processing fees

Who Is Eligible for an Education Loan?

Student Eligibility

- Indian citizen

- Confirmed admission to a recognized institution

- Undergraduate, postgraduate, or professional course

- Acceptable academic record

Co-Applicant Eligibility

- Parent, guardian, or spouse

- Stable income source

- Good credit history

Tips to Reduce Education Loan Interest

- Compare public and private banks

- Choose longer tenure to reduce EMI

- Pay interest during moratorium if possible

- Maintain good credit score

- Always calculate EMI before applying

Final Words

An Education Loan Interest Calculator helps students make informed financial decisions. By estimating EMI and interest in advance, students can avoid future repayment stress and choose the best student loan in India.